Understanding and Preparing for Post-Pandemic Medicaid Enrollment

As America rolled into 2023, Medicaid/CHIP enrollment stood at an all-time high, with more than 92 million people receiving coverage. More than 19 million people had enrolled between February 2020 and December 2022 for an unprecedented increase of 27% in just over two and a half years.

Now, as Medicaid redetermination marches into 2023, Medicaid enrollment will likely decrease drastically as previously covered populations are subject to churn and disenrollment. Is your team prepared to maintain coverage for your most vulnerable patient populations?

Understanding Medicaid growth (2020-2023)

First, it’s important to understand the factors that led to the 27% increase in Medicaid enrollment during the Public Health Emergency (PHE). While there are a multitude of reasons why someone may choose to enroll in Medicaid, there were three specific factors driving pandemic-era growth.

- Families First Coronavirus Response Act (FFCRA)

The main reason for Medicaid growth between 2020 and 2023 is the FFCRA, which was enacted in 2020 and required states to adopt a continuous enrollment provision for Medicaid patients. States were provided additional funding for Medicaid patients provided they did not disenroll any people during the PHE.

This provision has effectively halted Medicaid churn and disenrollment for over two years, meaning all patients enrolled in Medicaid from February 2020 on continued to receive coverage without having to re-enroll. Naturally, this has fueled exponential growth.

- Income disruptions

When the world shut down in March 2020, it led to a complete and widespread economic disruption. Unfortunately, many Americans lost their jobs as employers navigated this uncharted territory. Fortunately, Medicaid was standing by, able to act as a safety net for millions of people who lost employer-sponsored healthcare during this time.

- Medicaid expansion

The Affordable Care Act (ACA), passed in 2014, increased Medicaid eligibility for specific groups. However, not every state had accepted the ACA as of February 2020. The PHE provided increased Medicaid funding to states who expanded their Medicaid coverage. This opportunity drove more states to expand their coverage, leading to an increase in Medicaid patients. As of writing, 41 states (including Washington, D.C.) have expanded Medicaid

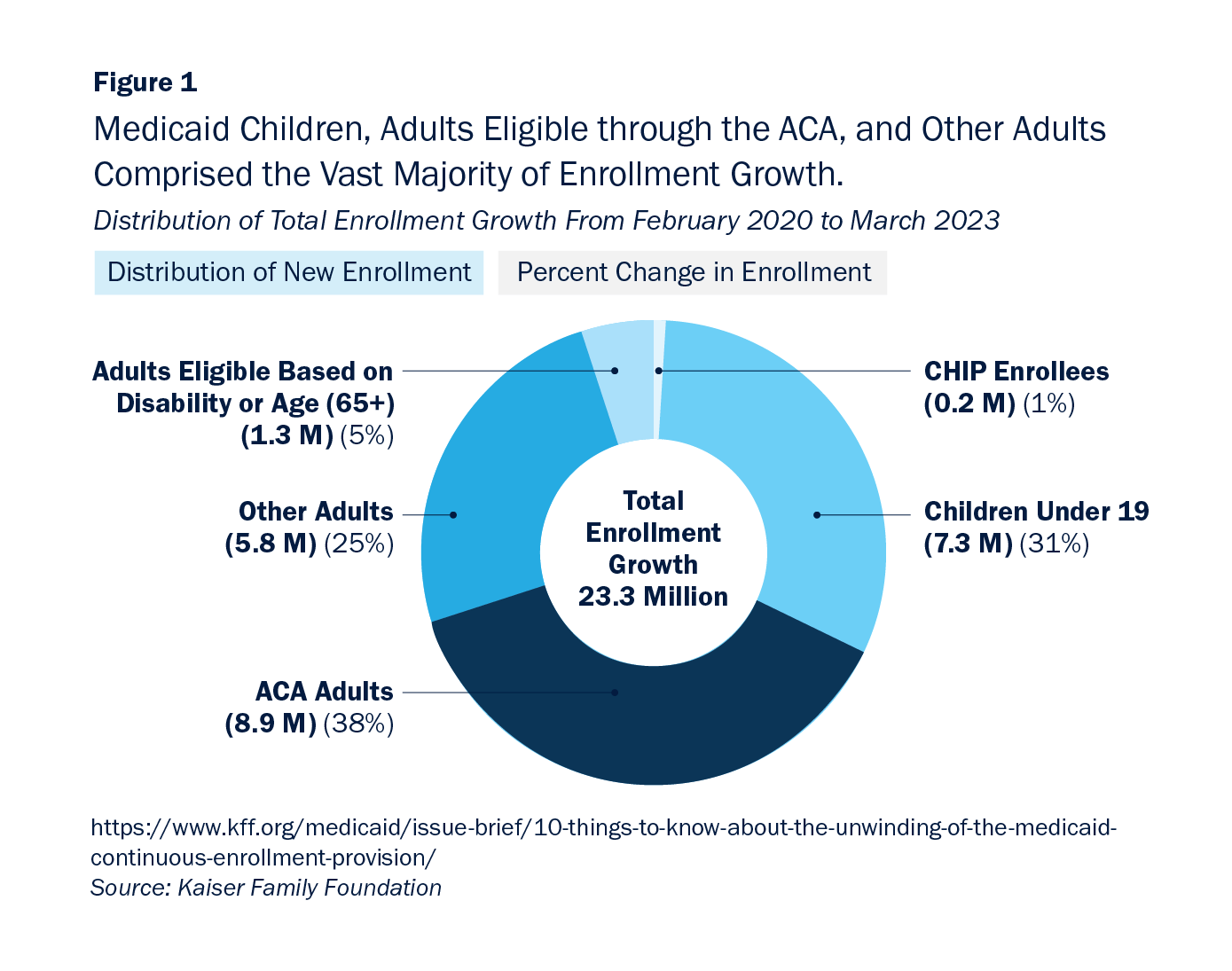

The majority of Medicaid enrollment growth during the pandemic came from adults newly eligible under the expanded ACA provisions (38%). The second largest group of enrollees was children under 19 (31%).

Understanding post-pandemic Medicaid enrollment

Now that the PHE has expired and Medicaid redetermination has begun, we can expect to see a decrease in Medicaid enrollment. It’s estimated that 15 million total people will lose Medicaid coverage.

Some of these people will have transitioned to employer-sponsored healthcare, while others may have experienced an increase in income that makes them ineligible for Medicaid coverage. However, at this moment, the spotlight is on the estimated 6.8 million Americans set to lose coverage despite remaining eligible.

Many people who enrolled in Medicaid during the PHE have never re-enrolled. They may not know they have to re-enroll at all, or they may not understand the process. Many states also have outdated, paper-based systems that are difficult to navigate and many patients are difficult to reach to initiate the re-enrollment process due to unstable housing or communication situations. Without up-to-date addresses, it’s likely these patients will never receive paper-based communications at all.

Who are the 6.8 million eligible people at risk of losing coverage?

The list of eligible Americans at risk of losing coverage is not homogenous or limited to one demographic. However, research has uncovered a series of patterns that suggest our most vulnerable populations are the ones most at risk.

- Low income populations

Medicaid is an important safety-net system for patients who do not have another affordable source of healthcare coverage. In 2022, 35% of Medicaid enrollees lived at or below the Federal Poverty Line (FPL). Americans living on limited incomes often face unstable housing situations, making it difficult to contact them via addresses on file, and barriers to accessing technology, making it difficult to initiate contact digitally.

- People of color

The racial makeup of Medicaid enrollees suggests redetermination will have a disproportionate impact on people of color, who are more likely to receive Medicaid coverage. In 2021, Black and Latino people made up roughly one-third of the U.S. population, but one-half of Medicaid recipients. One analysis from the U.S. Department of Health and Human Services estimated the 6.8 million eligible Americans at risk of losing coverage includes:

- 64% of Latino Medicaid recipients

- Around 40% of Black Medicaid recipients

- Half of all other non-white or multiracial Medicaid recipients

- Children

The same study showed that though children aged 0-17 make up just 20% of Medicaid enrollees, around half of these patients will lose coverage throughout redetermination, widely due to administrative and procedural reasons.

- Chronically ill populations

Generally speaking, Medicaid enrollees have always been more likely to report being in “fair” or “poor” health than private insurance enrollees. In 2020, around 21% of Medicaid patients were aged 65 and older and eligible on the basis of disability. This population made up about 56% of total Medicaid spending as people experiencing chronic illness are much more likely to spend increased time receiving care. It is difficult for a person experiencing chronic illness and in fair or poor health to complete the administrative tasks necessary to re-enroll in Medicaid, making them exceptionally vulnerable to churn.

What should you do next?

As healthcare finance professionals, our job is to protect these vulnerable populations and advocate for their continued coverage.

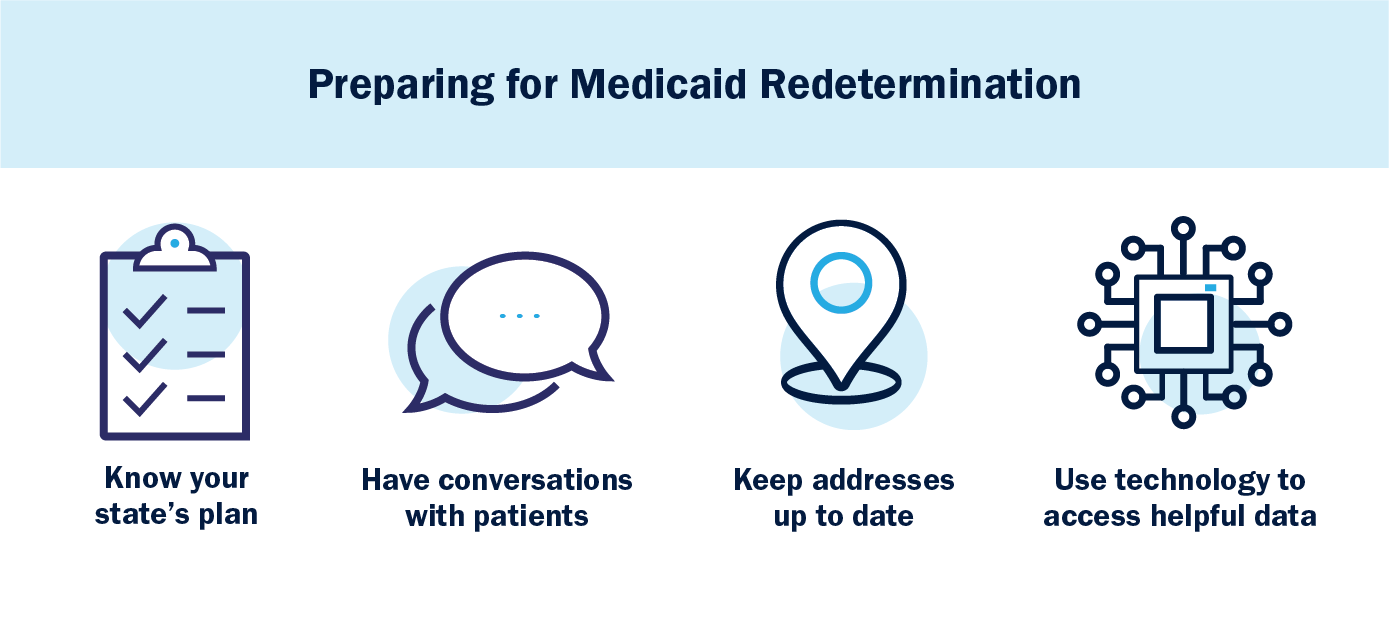

The first step to fulfilling this duty is to understand what your state is doing and how it plans to tackle redetermination. This research is key in communicating the process to your own patients.

Next, you should plan on having continued conversations with your Medicaid population, both in persona and online, about redetermination. If a Medicaid patient comes to your office to receive care, train staff to ask questions like “Have you recently enrolled in Medicaid?” and “Have you received communications about re-enrolling in Medicaid?” and guide them through the process from there.

Keep addresses as up-to-date as possible at all times to ensure smooth communications. Remember, hospitals are much more likely than state Medicaid institutions to keep updated information for patients, so you cannot plan to rely on the state.

Finally, if you haven’t already, now is the time to implement technology solutions that help you gather, process and make use of data to facilitate re-enrollment. For example, in some states hospitals now have access to realtime Medicaid eligibility verification checks and re-enrollment dates using state data.

Office Ally has been operating in the insurance verification and Medicaid eligibility and enrollment space for more than 20 years. We’re proud to serve as a trustworthy source of information and customizable software solutions to help you come out of this transition on top.

Not sure what data your state is providing to assist in redetermination - if any? We can easily check. We’re here to help. Contact Office Ally today to connect with one of our experts for more information.

.svg)

.png)

.png)