Looking Ahead: What Will the Aftermath of Medicaid Unwinding Look Like?

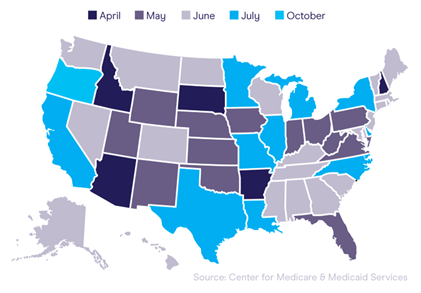

At the time of writing, we’re about four plus months into the unwinding, or redetermination, process, which officially began April 1, 2023. For most states, this process will stretch to 12 months, meaning we’re around one-quarter of the way through. Some key findings have started to emerge.

High numbers of Americans have lost Medicaid coverage

As of writing, at least 3,757,000 Americans have been disenrolled from Medicaid across 37 states and the District of Columbia. On average 38% of people who completed the enrollment renewal process lost coverage.

Disenrollment rates vary greatly across states

Because each state was given the freedom to choose its approach to Medicaid redetermination, we’re seeing major differences in disenrollment rates by state. At the start of the process, in May 2023, 12 states had completed 500,000 disenrollments, with more than half in Florida alone. Now, around three months in, disenrollment rates continue to exhibit wide variation. Consider these four states alone:

Most Americans have had coverage terminated for procedural reasons

According to the Kaiser Family Foundation, “Across all states with available data, 73% of all people disenrolled had their coverage terminated for procedural reasons.” Procedural disenrollments occur when a person does not complete the renewal process, despite potentially still remaining eligible for coverage.

CMS has paused redetermination in certain states

The redetermination process has seen its share of snags, most recently in July 2023 when CMS required some states to pause redetermination due to a rise in errors. While CMS did not name states or specify a number beyond “around a half dozen,” the organization did say it had found problems that violated federal laws and unwinding guidelines.

So far, Medicaid redetermination has lived up to its advanced billing as an unprecedented disruption in the healthcare landscape. But the story is still being written. States and providers still hold the power to lower procedural disenrollment rates, enhance communication with Medicaid populations and avoid errors in the process.

Looking ahead: What’s the aftermath?

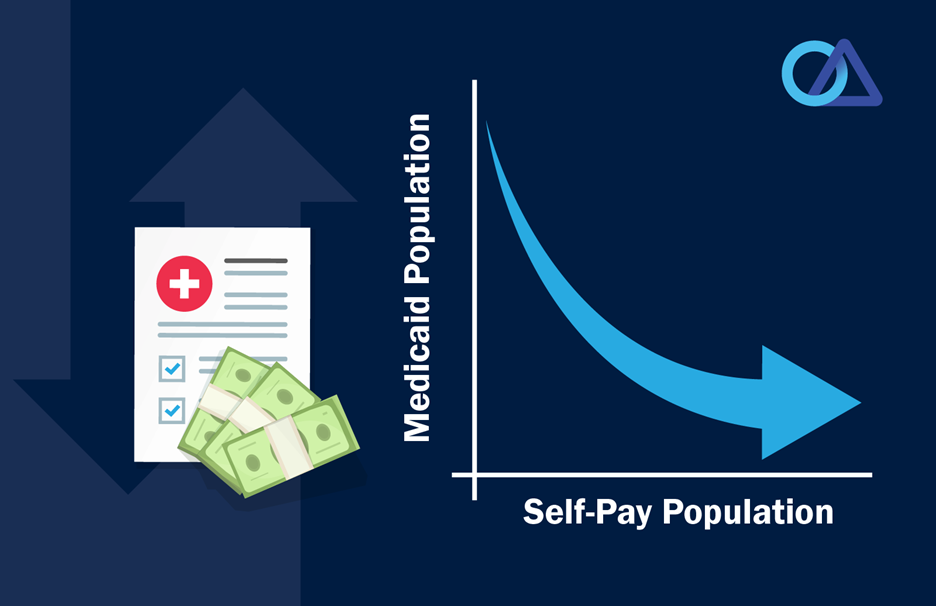

Based on what we’ve learned so far and what industry experts anticipate, there are several things we can expect to see at the end of the redetermination process April 1, 2024. Specifically, we can expect to see significant changes in the Medicaid population and self-pay patient population.

Medicaid population

In 2024, the Medicaid population overall will shrink after experiencing significant growth throughout the public health emergency (PHE). The population will also likely be a finer cut of those who are eligible following significant disenrollments for those no longer eligible and high rates of procedural disenrollments in many states.

Notably, those who remain enrolled will differ from the current population because nearly all will have experienced the renewal process and will know what to expect in the future. Ideally, these patients will emerge from unwinding as a more educated consumer with a deeper understanding of the Medicaid process and what is required for them to continue coverage.

Self-pay population

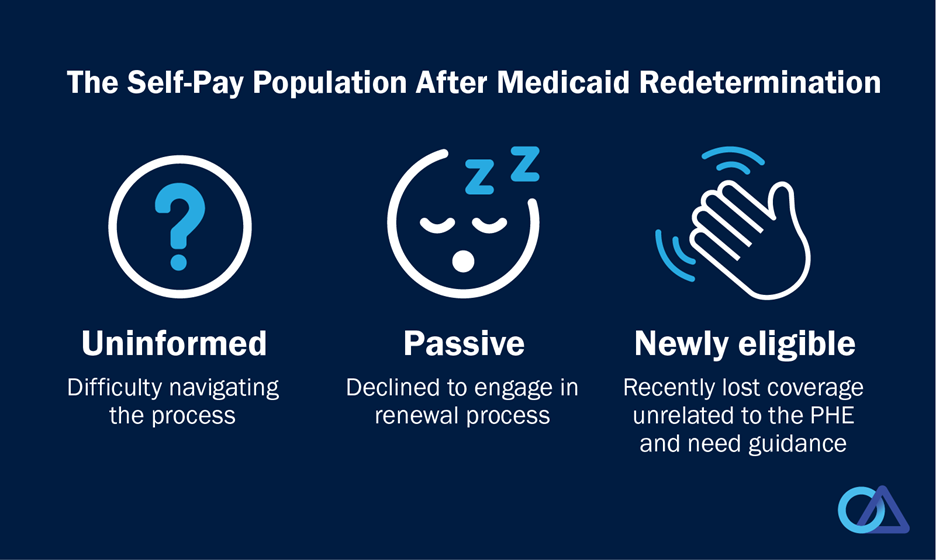

While the Medicaid population will shrink, the self-pay population, in turn, will grow. We can anticipate that growth in three distinct groups among self-pay patients.

As healthcare finance professionals, it’s our goal to help all three of these groups get coverage.

Three key takeaways for providers

Despite being a major disruption to the American healthcare system, Medicaid redetermination has also proven to be an excellent learning opportunity for providers. Hospitals and health systems that have been a resource for the re-enrollment process will inevitably strengthen their relationships with patient populations.

Providers who have already taken an active role in redetermination, or still plan to take an active role, have the opportunity to gain experience in key areas that will enhance patient relationships in future after redetermination has ended.

As additional technology tools become available, some just for hospitals and certified application counselors and assisters, providers need to develop a solid understanding of the resources available to patients and staff.

Data & technology tools available for use

Hospitals nationwide are benefiting from internal resources that increase efficiency while reducing the need for human capital.

At Office Ally, we provide access to comprehensive data to help you better better understand patient eligibility and coverage options, including credit scoring and comprehensive insurance discovery.

Office Ally also provides technology solutions to facilitate patient outreach and engagement via our MAPS-Clear patient portal. The MAPS-clear patient portal can serve as an outreach tool to draw patients into the financial counseling process and facilitate communication.

No matter the outcome of Medicaid redetermination, the process will inevitably provide hospitals with valuable knowledge that will help improve patient relationships and manage any future disruptions. For best results now and after April 1, 2024, use this time as a learning opportunity to reevaluate your self-pay management and make changes for the better.

Simplify and improve your self-pay management with technology and data available from Office Ally. Contact us today and connect with one of our experts for more information.

.svg)

.png)